Nyheter

Blir den en tuff sommar för börsen i år?

Publicerad

8 år sedanden

Blir den en tuff sommar för börsen i år? Den nuvarande börsuppgången, det vi i vanligt fall kallar för en tjurmarknad, eller en bull market, har nu pågått under 85 månader, och den fortsätter. Investerarna har vaggats in i ett självbelåtet läge sedan S&P 500 sedan 2014 har handlats i intervallet 1 820 till 2135. På dagens aktiemarknad är det gott om investerare som aldrig har upplevt en börs som går i sidled, än mindre varit med om otrevliga börsfall. Det mest oroväckande de har sett är att börsen har rasat till botten av handelskanalen för att sedan studsa upp igen med full fart upp till sin all-time-high. Den allmänna uppfattningen är att aktiemarknaden kommer att fortsätta uppåt igen, och att det därför är viktigt att vara inne på börsen.

Det har funnits tider när det räckt att blunda och välja aktier, men detta tillvägagångssätt fungerar inte längre. Tillvägagångssättet fungerar bra när börsen i sin helhet är undervärderad och det finns en underliggande stark tillväxt. I dag finns inte dessa förutsättningar eftersom det saknas makroekonomiska förutsättningar för ett kommande börsrally. Det finns bedömare som anser att börsen i dag är perfekt prissatt.

FED kommer att komma till räddning

Många investerare har länge levt i tron att den amerikanska centralbanken FED kommer att hålla dem om ryggen, och vem kan egentligen klandra dem för ett sådant tankesätt? Vi har under många år sett at varje gång som ekonomin har vänt ned och börsen börjat falla så har FED gått in med stöd och pengar samt ändrat sin penningpolitik på ett sådant sätt att centralbankens agerande har stöttat aktiemarknaden.

Situationen har emellertid förändrats eftersom FED, precis som så många andra centralbanker, har börjat får slut på verktyg för att stötta upp ekonomin och aktiemarknaden. Förr eller senare kommer ekonomin att åter börja sakta ned och aktiemarknaden utsättas för en kraftig korrektion nedåt. Frågan är om Janet Yellen kommer att kunna agera riddare i nöden den dagen det inträffar?

Det finns tillfällen när börsen stiger utan att det egentligen finns några ekonomiska förutsättningar eller starka framtidsutsikter som stödjer detta. Baserat på historiska data är det sannolikt att anta att den amerikanska börsen (som i allmänhet befinner sig för Europa och Sverige) kommer att utvecklas svagt, till och med ogynnsamt under det kommande halvåret, till slutet av oktober. Vi har tidigare sett hur rapporterna för det första kvartalet 2016 inkom betydligt svagare än för det första kvartalet 2015 och det är ovanligt att se stora vinstökningar under en svag börs, det krävs i allmänhet en stark katalysator för att driva upp vinsterna för hela börsen. Det finns all anledning att oroa sig för att börsen är övervärderad. Det finns i dag ingen större potential för ökade vinster, det saknas möjligheter till stöd från många centralbanker som har gått över till negativa räntor och vi har en period som historiskt sett visat en svag utveckling framför oss.

Långvarig börsuppgång

(Klicka för att förstora bilden) Längden på en börsuppgång säger inget om hur en investerare kommer att agera på aktiemarknaden i framtiden. En börsuppgång kan fortsätta betydligt längre än vad placerarna tror, men den nuvarande längden på börsuppgången kan ge en indikation om att aktiemarknaden inte kan fortsätta upp hur länge som helst. Historiskt sett har börsuppgången, mätt i form av kursutvecklingen på S&P 500 sedan 1929 stigit med i snitt 31 månader och gett en uppgång på 107 procent.

Den nuvarande börsuppgången började den 9 mars 2009 och har således löpt under 85 månader. Under samma tid har S&P 500 stigit med 205 procent. Både tidsmässigt och resultatmässigt dubbelt så mycket och långt som den genomsnittliga börsuppgången,

Tre rekordlånga börsuppgångar

De enda tre tjur marknader som har producerat större vinster än den nuvarande är perioderna 1949 till 1956, 1982-1987 och börsuppgången 1987 till 2000. Det betyder att även om den nuvarande börsuppgången står ut jämfört med genomsnittet sedan 1929 så är det inte fullt så anmärkningsvärt jämfört med den genomsnittliga börsuppgången sedan 1949, även om den är starkare än genomsnittet. Sedan andra världskriget har börsuppgångarna varat längre och gett högre avkastning.

Det finns anledningar till detta fenomen, till exempel den snabba utvecklingen för den amerikanska industrin, tekniska framsteg, tillkomsten av Internethandel och FEDs ständiga stöd till aktiemarknaden. Frågan är om detta räcker för att börsen skall kunna fortsätta stiga? Det finns all anledning att tro att det blir en tuff sommar för börsen i år.

(Klicka för att förstora bilden)

Du kanske gillar

-

Tillgång till Nasdaq 100 och S&P 500 E-mini-terminer samt Euro STOXX 50 med 5x hävstångseffekt

-

Ny börshandlad fond från Deka ger tillgång till S&P 500-index

-

State Street sänker avgiften på tre S&P 500 börshandlade fonder

-

FED är klara nu säger SEB

-

Höjer FED räntan till högsta nivån på 22 år?

-

Stor handelsplattform ser ökat intresse för obligationsfonder

Nyheter

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

Publicerad

19 timmar sedanden

15 maj, 2024

• European Economy Booms while Regulators Consider Adopting Crypto

• Bitcoin’s Growing Fundamentals and Institutionalization

• Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

European Economy Booms while Regulators Consider Adopting Crypto

Europe’s economy has exceeded expectations, with Germany’s gross domestic product (GDP) for Q1 2024 increasing by 0.2%, compared to the previous quarter’s reading of -0.5%. Additionally, France, Italy, and Spain are also seeing progress, picking up the bloc’s GDP from -0.1% to 0.3%. This is a good sign that Europe is on the right track away from a recession. Matching the positive outlook, regulators appear receptive to including new alternative assets within the EU’s most established regulatory framework.

Namely, the European Securities and Markets Authority (ESMA) is considering cryptoassets, among other asset classes like commodities and precious metals, in its Undertakings for Collective Investment in Transferable Securities (UCITS). Similar to mutual funds in the U.S., UCITS funds can be registered and sold in any country in the EU using unified regulatory and investor protection requirements. These funds are considered safe, well-regulated investments, hence their €12T market valuation and popularity among pension funds and risk-averse investors.

On May 7, ESMA invited investors and trade associations, among others, for a consultation to assess possible benefits and risks of UCITS gaining exposure to the selected 19 asset classes, having until August 7 to gather input. This is important since UCITS accounts for 75% of all collective retail investments in the EU. Thus, if the conclusions of this consultation are in favor of adopting crypto, it would attract an influx of investors and bring more regulated accessibility to this asset class. Moreover, although still under consultation, ESMA’s deliberation adds more credibility to crypto, considering the regulator’s renowned strict regulatory standards.

Further, the EU’s inflation is inching towards the 2% target, overshooting by only 0.4% in the past month, a level the U.S. is yet to achieve, with March’s inflation hitting 3.5%. Later today, a strong gauge for inflation is coming out, the Producer Price Index (PPI), measuring the change in the price of finished goods and services sold by producers. With the last consumer price index (CPI) disappointing, all eyes are on the CPI print coming out this Wednesday, along with data on retail sales. Although optimism seems to have checked out, a cooled inflation rate would recover investors’ appetite for risk-on assets like crypto, instigating more flows into Bitcoin spot ETFs, which have been especially quiet over the past week, as shown in Figure 1.

Figure 1: US Spot Bitcoin ETFs Flows

Source: Glassnode

Nevertheless, Bitcoin’s narrative has been growing beyond its primary use case as a store of value, with companies and governments alike leveraging Bitcoin mining to reduce their negative impact on the environment, ironically something Bitcoin is often scrutinized for.

Bitcoin’s Growing Fundamentals and Institutionalization

On May 7, Genesis Digital Assets and Argentina’s state-owned YPF Luz, the country’s largest producer of oil and gas with a ∼40% share in 2021, announced their opening of a Bitcoin mining facility. The data center takes ‘stranded gas,’ a byproduct of oil and gas production that would otherwise be flared and contribute to greenhouse gas emissions, to power the mining operation with the potential to reduce carbon dioxide equivalent emissions by 25-63%. Notably, 50 major oil and gas companies, representing over 40% of global petroleum production, signed the Oil and Gas Decarbonization Charter (OGDC), thereby committing to end gas flaring by 2030. The Argentinian project serves as a prime example of how companies can achieve the goals outlined in the OGDC, an approach likely to be replicated by others potentially using Bitcoin.

Aside from the obvious environmental benefits, projects like these actually strengthen Bitcoin’s network! More miners joining the fray means greater computing power, reflected by the growing hash rate in Figure 2. This results in a more secure network, as 51% attacks become more costly to execute successfully. The development comes at a crucial point in time, calming fears over miners exiting the network to cover costs, a dynamic often witnessed post-halving and one we explored in our Bitcoin Halving Report.

Figure 2 – Bitcoin Growing Hash Rate

Source: 21co on Dune

On a more familiar note, institutions continue to gobble up Bitcoin as an investment opportunity. The recent 13F filings mentioned last week revealed a growing appetite for Bitcoin as investment managers continue to disclose their U.S. equity holdings to the SEC. Quantitative trading firm Susquehanna holds over $1B in Bitcoin ETFs, with Boston-based hedge fund Bracebridge disclosing their $380M position too. Furthermore, in Japan, a weakened yen and government debt reaching 250% of GDP confirms sustained economic pressure, which has led early-stage investment firm Metaplanet to adopt Bitcoin as a strategic reserve. They have acquired over $7M since April, another testament to Bitcoin’s value proposition as a safe haven. The continuous adoption of Bitcoin is no surprise, given the accessibility of Bitcoin ETFs to traditional institutions through a regulated and familiar investment vehicle.

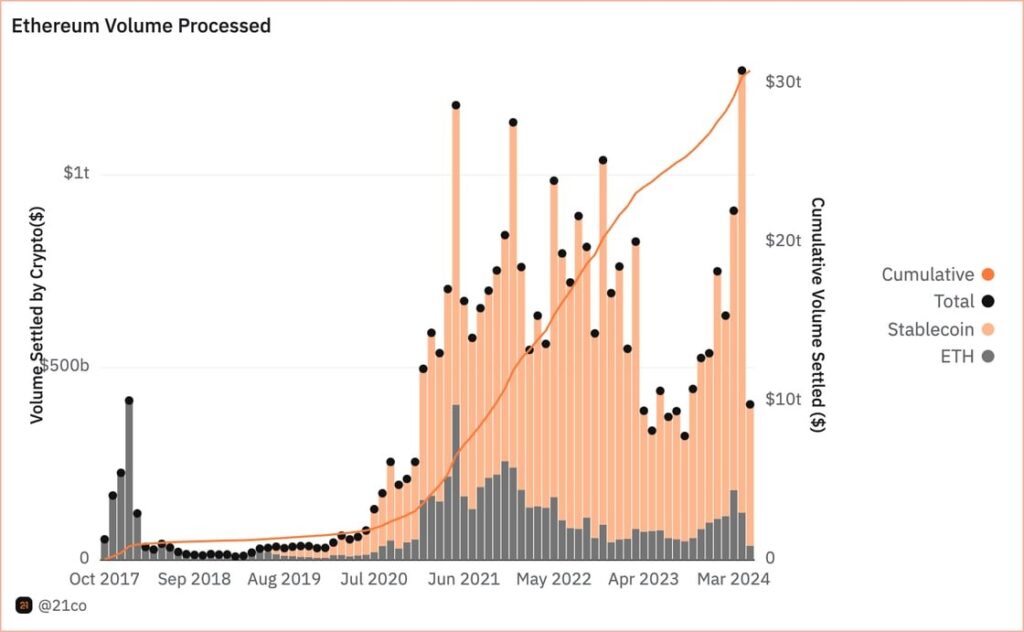

The positive Bitcoin sentiment is amplified by continuous innovation on the network itself. Bitcoin’s prime scaling solution, the Lightning Network, has taken a significant leap forward. By leveraging the Taproot Asset Upgrade, the Lightning Network successfully tested a protocol for issuing stablecoins directly on Bitcoin. This underscores the trend of Bitcoin’s growing use cases following the launch of Runes, which unlocked the ability to launch fungible tokens on Bitcoin. The recent surge in on-chain activity is reminiscent of the ERC-20 explosion in Ethereum’s early days, and stablecoins would truly unlock Bitcoin’s DeFi potential. They facilitate a wide range of transactions, shown below by Ethereum stablecoins amassing $3.8T in 2024 processed volume so far.

Figure 3 – Ethereum Stablecoin Volume

Source: 21co on Dune

While still in the early stages, this development would also significantly boost miner revenue, offering them a much-needed additional income stream through transaction fees, following the halving of block rewards last month. The potential of stablecoins on Bitcoin will be monitored going forward, as they have clear implications for the network’s potential on-chain footprint.

Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

More information is finally starting to come out regarding Ethereum’s next major upgrade, slated for late this year or early next year. Known as Pectra, the upgrade promises to introduce a range of enhancements aimed at bolstering the network’s stability and refining user experience. For example, the upgrade will raise the maximum stake per validator from 32 to 2,048 ETH, streamlining the management process for large validators who spread their stake across multiple wallets. Moreover, Pectra will tackle the problem of empty accounts, those with zero assets or funds, by removing them from the network. This action reduces the network’s state size, which effectively leads to lighter transaction processing.

Although the upgrade will incorporate various Ethereum Improvement Proposals (EIPs), one in particular stands out. Referred to as EIP 7702, Vitalik Buterin’s new proposal aims to expand upon the advancements made in Account Abstraction (AA) on Ethereum by refining certain concepts introduced in an earlier proposal, EIP 3074. As a quick recap, AA transforms users’ wallets, externally owned accounts (EOAs), into more sophisticated accounts resembling smart contracts, enhancing security, flexibility, and simplified user management. That said, EIP 7702 addresses some of EIP 3074 criticisms by steering clear of dependencies on EOA-specific functionalities. It aims to establish a versatile system capable of meeting the evolving needs of the Ethereum ecosystem while helping to reduce technical debt for the network

However, EIP 7702 proposes several other enhancements, including batched transactions, which could enhance transaction efficiency and even reduce fees by consolidating multiple user actions. Another exciting feature is the introduction of s sponsored transactions, which allow third-party applications to cover transaction fees for consumers, an ideal solution for onboarding new users. Finally, the upgrade could make users’ accounts resistant to threats from quantum computing. That said, with the proposal’s introduction of a new transaction type enabling EOAs to temporarily transition into smart accounts, concerns arise regarding the heightened risk of malicious actors’ ability to swiftly drain user wallets. Nevertheless, Vitalik’s proposal is intriguing as it charts a more pragmatic course toward realizing the AA vision. This is pivotal because it echoes our thesis at 21Shares that crypto won’t onboard millions of more users without providing them with an intuitive interface resembling the user-friendly experience they are familiar with across Web2.

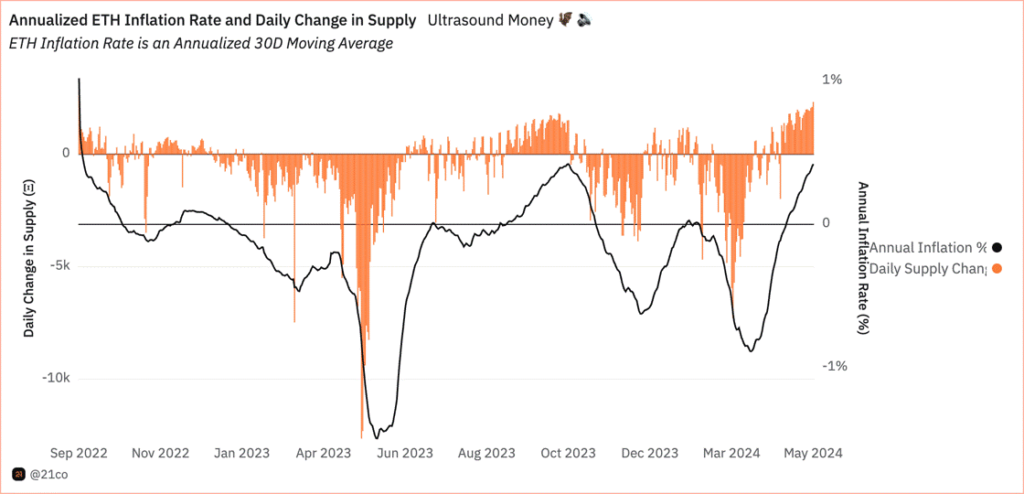

Now, while Ethereum’s long-term prospects remain promising, its status as a deflationary network has come under threat in recent weeks, as seen below in Figure 3. This decline is primarily attributed to decreasing on-chain activity, which peaked at the end of March. Furthermore, the DenCun upgrade, implemented in March, significantly reduced the costs L2s incurred for storing their data on Ethereum by 90%.

Figure 4 – Ethereum’s Inflation

Source: 21co on Dune

It is worth noting that while it is currently more cost-effective for L2s to operate on Ethereum, these reduced costs will eventually onboard a larger user base. This will make it more feasible for applications, especially those requiring a high volume of interactions, to operate within the Ethereum ecosystem, which was previously economically unviable. A pivotal piece of evidence supporting this perspective is Arbitrum’s recent milestone, onboarding approximately 600K daily active users, as depicted in Figure 4. This likely influenced Securitize’s decision to propose deploying Blackrock’s BUIDL on Arbitrum, considering its position as the pioneering L2 platform with such a vibrant user base, alongside being the first L2 to process over $150B in swap volume on Uniswap, putting Arbitrum as the leading Ethereum scaling solution. Nevertheless, readers shouldn’t be wary, as we expect a broader spectrum of applications to arrive at the Ethereum network, helping to fill in the gap for Ethereum’s lost revenue while expanding the universe for what is possible within its ecosystem.

Figure 4 – Daily Active Users of Ethereum’s Leading Solutions

Source: GrowThePie

This Week’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

CRPA ETF investerar i företagsobligationer och återinvesterar utdelningen

Publicerad

20 timmar sedanden

15 maj, 2024

iShares Global Corporate Bond UCITS ETF USD (Acc) (CRPA ETF) investerar i företagsobligationer med fokus på World. ETF:n innehar hela utbudet av obligationsförfall. De underliggande obligationerna har Investment Grade-betyg. Ränteintäkterna (kupongerna) i fonden återinvesteras (ackumuleras).

Den totala kostnadskvoten uppgår till 0,20 % p.a. Fonden replikerar resultatet för det underliggande indexet genom att köpa ett urval av de mest relevanta indexbeståndsdelarna (samplingsteknik). iShares Global Corporate Bond UCITS ETF USD (Acc) har tillgångar på 116 miljoner GBP under förvaltning. ETF:en är äldre än 3 år och har sin hemvist i Irland.

Varför CRPA?

Diversifierad exponering mot globala företagsobligationer

Direktinvesteringar i företagsobligationer över sektorer (industri, allmännyttiga och finansiella företag)

Obligationsexponering med investeringsgrad

Investeringsmål

Fonden strävar efter att följa utvecklingen av ett index som består av företagsobligationer av investeringsklass från emittenter på tillväxtmarknader och utvecklade marknader.

Investeringsstrategi

Bloomberg Global Aggregate Corporate-index spårar företagsobligationer i amerikanska dollar utgivna av företag över hela världen. Alla löptider ingår. Betyg: Investment Grade.

Handla CRPA ETF

iShares Global Corporate Bond UCITS ETF USD (Acc) (CRPA ETF) är en europeisk börshandlad produkt som handlas på London Stock Exchange.

London Stock Exchange är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | SXRB |

| London Stock Exchange | USD | CRPA |

Största innehav

| Emittent | Vikt (%) |

| BANK OF AMERICA CORP | 1.83 |

| JPMORGAN CHASE & CO | 1.63 |

| GOLDMAN SACHS GROUP INC/THE | 1.29 |

| MORGAN STANLEY | 1.15 |

| CITIGROUP INC | 1.13 |

| WELLS FARGO & COMPANY | 1.12 |

| VERIZON COMMUNICATIONS INC | 0.97 |

| AT&T INC | 0.95 |

| APPLE INC | 0.84 |

| HSBC HOLDINGS PLC | 0.78 |

Innehav kan komma att förändras

Nyheter

Timely and concise insights on Bitcoin & Cryptoasset Markets

Publicerad

22 timmar sedanden

15 maj, 2024

• Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

• Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

• Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

Gradually, then suddenly, as they say, digital assets are becoming mainstream.

The biggest asset managers in the world have launched spot Bitcoin ETFs in the US this year and adoption among institutional investors is rising rapidly.

Major financial institutions like Franklin Templeton themselves have just recently disclosed significant investments into Bitcoin ETFs via their latest 13F filings.

Institutional hedge funds that manage money for Ivy League university endowments have disclosed multi-million Dollar holdings. Stanford university’s Blyth Fund has recently disclosed that they hold around 7% allocation in Bitcoin ETFs.

Nonetheless, at the time of writing, US Bitcoin ETFs only account for approximately 0.6% of the overall size of the US ETF market based on data provided by ICI.

In Europe, Bitcoin ETPs also only comprise a tiny fraction of the 11 trn EUR UCITS market of only 0.05%, according to our calculations based on Bloomberg data.

In general, we expect the relative size of digital assets to increase further as even small allocations to digital assets are bound to increase portfolio risk-adjusted returns significantly as demonstrated in our latest deep dive on Bitcoin.

But what is the optimal allocation to Bitcoin and digital assets in general?

What is the optimal allocation to digital assets?

Most empirical portfolio studies usually look at how a classical 60/40 portfolio comprising of 60% allocation in stocks and 40% allocation in bonds responds to a gradual increase in digital asset allocation.

In our previous digital asset study, we did a similar exercise by investigating the effect of increases in digital asset allocation on overall portfolio risk and return metrics.

Since digital assets generally exhibit a higher risk-adjusted return (“Sharpe Ratio”) than other traditional asset classes, a marginal increase in allocation usually leads to an increase in overall portfolio risk-adjusted returns.

However, most institutional asset managers don’t employ a 60/40 portfolio in the first place because of high portfolio volatility and the dominance of the equity allocation for the whole portfolio’s risk-return profile.

In fact, most institutional asset managers in practice allocate based on optimized risk metrics such as portfolio Sharpe Ratio or portfolio volatility which is why we perform a similar exercise here.

In a first step, we looked at optimized multiasset portfolios comprising of global stocks (MSCI World AC), global bonds (Bloomberg Global Aggregate USD-hedged), and commodities (Bloomberg Commodity Index).

More specifically, we optimized these portfolios based on the following approaches:

• Minimum Variance/Volatility

• Maximum Sharpe Ratio

• Equal risk contribution (Risk parity)

The Minimum Variance approach tries to minimize the average portfolio volatility.

The Maximum Sharpe Ratio approach tries to maximize the ratio between average portfolio return (minus a risk-free return) and the corresponding average volatility. The Equal risk contribution or Risk Parity approach varies the respective portfolio weights until every asset has an identical relative contribution to the overall portfolio volatility.

In a second step, we added Bitcoin to the set of potential assets into the optimization. Our period of investigation (July 2010 – May 2024) was constrained by the fact that reliable market prices for Bitcoin only exist since 2010 as it is still a relatively young asset.

Here are the results for the different optimizations. The upper panel excludes Bitcoin while the lower panel includes Bitcoin in the optimization:

Several observations are in order:

Firstly, the minimum variance approach excludes Bitcoin completely since Bitcoin generally exhibits a higher level of volatility than the other assets.

Secondly, the maximum Sharpe Ratio approach excludes commodities in the traditional portfolio but includes Bitcoin in the new portfolio. The Bitcoin allocation is made largely at the expense of the stock allocation.

Lastly, the risk parity approach also includes Bitcoin at the expense of all other asset classes.

Furthermore, a comparison between the historical performances of the traditional portfolios that exclude Bitcoin and those that include Bitcoin reveals that the max Sharpe Ratio and the Risk Parity (ERC) portfolio were able to significantly outperform the Minimum Variance portfolio which didn’t allocate to Bitcoin at all.

It is also important to highlight that the Risk Parity portfolio with Bitcoin even exhibited a smaller maximum drawdown than the Minimum Variance portfolio without Bitcoin. In other words, the increase in portfolio volatility was largely due to an increase in positive upside volatility.

Moreover, investors are over-proportionately rewarded with higher returns for unit of additional risk as the risk-adjusted returns (“Sharpe Ratio”) increase significantly by adding Bitcoin.

The Sharpe Ratios for optimized portfolios with Bitcoin are even significantly higher than for optimized portfolios without Bitcoin.

In fact, by including Bitcoin and digital assets into their portfolio optimization, the universe of potential multiasset portfolios increases vastly.

Asset managers are not only enabled to provide investors with more efficient portfolios, i.e. higher risk-adjusted returns, but also provide investors with a much larger set of risk-return combinations compared to traditional portfolios that only include stocks, bonds, and commodities.

So far so good. What about other digital assets?

We also applied the same portfolio optimization approaches to a basket of the top 20 digital assets based on the MSCI Global Digital Assets Select 20 Capped Index.

–> The optimal % allocation is even higher in case of the Maximum Sharpe Ratio and Risk Parity portfolio optimization.

It is important to note that the period of investigation (November 2019 – May 2024) is much smaller due to the fact that younger digital assets within the top 20 digital assets like Solana or Ethereum have a smaller track record than Bitcoin.

All in all, the abovementioned results imply that even a small allocation to digital assets can have very positive effects on risk-adjusted returns without compromising the risk characteristics of the portfolios.

While highly risk-averse investors should probably avoid digital assets, the optimal allocation based on the Max Sharpe Ratio and Risk Parity approach appears to be between 2% and 3% for the full sample with bitcoin and between 4% and 6% for the smaller sample with a basket of the top 20 digital assets.

The results generally support our previous findings that we presented here.

Most portfolio optimization approaches also include digital assets within the optimal portfolio allocation which demonstrates that any modern portfolio approach that doesn’t include digital assets like Bitcoin is probably sub-optimal.

We recommend that agile asset managers familiarise themselves with this emerging asset class for the benefit of their clients and to remain competitive.

Bottom Line

• Growing Mainstream Adoption of Digital Assets: Institutional investors and major asset managers are increasingly incorporating digital assets like Bitcoin into their portfolios, as evidenced by recent filings and the launch of Bitcoin ETFs in the U.S. Despite their current small market share, these investments reflect a broader trend towards mainstream acceptance

• Impact on Portfolio Performance: The inclusion of Bitcoin in portfolio optimizations, using strategies such as Maximum Sharpe Ratio and Risk Parity, has shown to improve the risk-adjusted returns compared to traditional portfolios. Portfolios optimized with Bitcoin not only offer higher returns for the additional risk taken but also present a wider range of efficient risk-return combinations

• Optimal Allocation Recommendations: Empirical studies suggest that even a small allocation to digital assets, specifically between 2% to 3% in broader asset mixes and up to 4% to 6% in more focused digital asset portfolios, significantly enhances portfolio performance without adversely impacting overall risk profiles

To read our Crypto Market Compass in full, please click the button below:

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

CRPA ETF investerar i företagsobligationer och återinvesterar utdelningen

Timely and concise insights on Bitcoin & Cryptoasset Markets

Valour Inc. lanserar världens första avkastningsbärande Bitcoin (BTC) ETP

Virtune lanserar Virtune Staked Cardano ETP på Nasdaq Stockholm

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Vilken är den bästa fond som följer Nasdaq-100?

De mest populära börshandlade fonderna april 2024

Några av de bästa guldfonderna

Sveriges enda riktiga råvarufond har öppnat

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDe mest populära börshandlade fonderna april 2024

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNågra av de bästa guldfonderna

-

Nyheter4 dagar sedan

Nyheter4 dagar sedanSveriges enda riktiga råvarufond har öppnat

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanEndast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanU.S. Global Investors tar över HANetf Travel

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBTC1 ETP spårar priset på kryptovalutan Bitcoin