Deutsche Asset & Wealth Management alters ETF product line and enhances Swedish offering Deutsche Asset & Wealth Management (Deutsche AWM) is altering its exchange-traded fund (ETF) line up on the Nasdaq Stockholm by de-listing certain funds while rolling out a suite of new offerings.

Ten db X-trackers ETFs will be de-listed from the Stockholm market while seven new listings will take place with a view to offering investors a broad range of international equity exposures, spanning both developed and emerging equity markets, as well as single countries. Dividend and small cap strategies for selected developed markets will also be offered. Additional ETFs from Deutsche AWMs Core-ETFs range will also be added to the product suite.

Those ETFs that are de-listing in Stockholm will continue to be listed on exchanges elsewhere in Europe. Following the changes, Deutsche AWM will continue to be the biggest ETF manager locally based on number of listed ETFs.

“We first listed ETFs on the Nasdaq OMX in 2010 and our continuing commitment to the local market is reflected in the enhanced product line-up. Our strategy is to deliver relevant international equity exposure locally, so investors in the region can use our ETFs as building blocks for cost-effective and diversified portfolios,” said Erik Rotander, Head of Nordics, Passive Investments, at Deutsche AWM.

Deutsche AWM’s European-listed db X-trackers ETFs have generated almost EUR 8 billion of inflows year-to-date (Source: Deutsche AWM, 13 August, 2015). This follows the successful move to become one of the Europe’s leading providers of physical ETFs following a programme of switching replication strategy on some of its largest funds by assets under management.

A table of db X-trackers ETFs that will constitute the new Nasdaq Stockholm-listed product suite – including ETFs due to list – is below, as well as a list of those ETFs de-listing. A Q&A on the alteration of the product line-up is available at www.etf.deutscheawm.com

For further information please contact:

John Ferry

Deutsche Asset & Wealth Management

New product line-up on the Nasdaq Stockholm

Green products remain listed. Blue products are additional listings

De-listings on the Nasdaq Stockholm (And exchanges where the ETFs remain listed)

Deutsche Asset & Wealth Management With EUR 1.14 trillion of assets under management (as of June 30, 2015), Deutsche Asset & Wealth Management¹ is one of the world’s leading investment organizations. Deutsche Asset & Wealth Management offers individuals and institutions traditional and alternative investments across all major asset classes. It also provides tailored wealth management solutions and private banking services to high-net-worth individuals and family offices.

Deutsche Asset & Wealth Management is the brand name of the Asset & Wealth Management division of the Deutsche Bank Group. The legal entities offering products or services under the Deutsche Asset & Wealth Management brand are listed in contracts, sales materials and other product information documents. www.db.com

Key risks

Investors should note that the db X-trackers UCITS ETFs1 are not capital protected or guaranteed and investors should be prepared and able to sustain losses of the capital invested up to a total loss.

Shares in db X-trackers UCITS ETFs which are purchased on the secondary market cannot usually be sold directly back to the relevant fund. Investors must purchase and redeem such shares on the secondary market with the assistance of an intermediary (e.g. a market maker or a stock broker) and may incur fees for doing so (as further described in the applicable prospectus). In addition, investors may pay more than the current net asset value of a share in a db X-trackers UCITS ETF when buying shares on the secondary market, and may receive less than the current net asset value when selling such shares on the secondary market.

Investments in funds involve numerous risks including, among others, general market risks, credit risks, foreign exchange risks, interest rate risks and liquidity risks. The value of an investment in a db X-trackers UCITS ETF may go down as well as up and investors may not get back the full amount of their original investment.

Important Notice

This press release has been issued and approved by Deutsche Bank AG, London Branch and has been prepared solely for information purposes and, offer or a recommendation to enter into any transaction.

Deutsche Bank AG is authorised under German Banking Law (competent authority: European Central Bank) and, in the United Kingdom, by the Prudential Regulation Authority. It is subject to supervision by the European Central Bank and by BaFin, Germany’s Federal Financial Supervisory Authority, and is subject to limited regulation in the United Kingdom by the Prudential Regulation Authority and Financial Conduct Authority. Deutsche Bank AG is a joint stock corporation with limited liability incorporated in the Federal Republic of Germany, Local Court of Frankfurt am Main, HRB No. 30 000; Branch Registration in England and Wales BR000005 and Registered Address: Winchester House, 1 Great Winchester Street, London EC2N 2DB.

Please refer to the relevant fund’s full prospectus and the latest version of the Key Investor Information Document for more information on db X-trackers UCITS ETFs. These documents are available free of charge from Deutsche Bank AG, London Branch and constitute the only binding basis for purchase of shares in the ETFs. As explained in the relevant offering documents, distribution of ETFs is subject to restrictions in certain jurisdictions. The ETFs described herein may neither be offered for sale nor sold in the USA, in Canada, in Japan to US Persons or to persons residing in the USA.

The indices mentioned herein are registered trademarks of their respective licensors. The ETFs described in this document are not sponsored, endorsed, sold or promoted in any way by the Licensors of the indices mentioned herein (with the exception of Deutsche Bank AG). The Licensors of the indices mentioned here (including Deutsche Bank AG) make no representations or warranties concerning the results obtained by using their indices and/or index levels or in any other respect, on any given day. The index sponsors are not liable for errors in their indices and are not obliged to provide information of such errors.

All-in Fee:

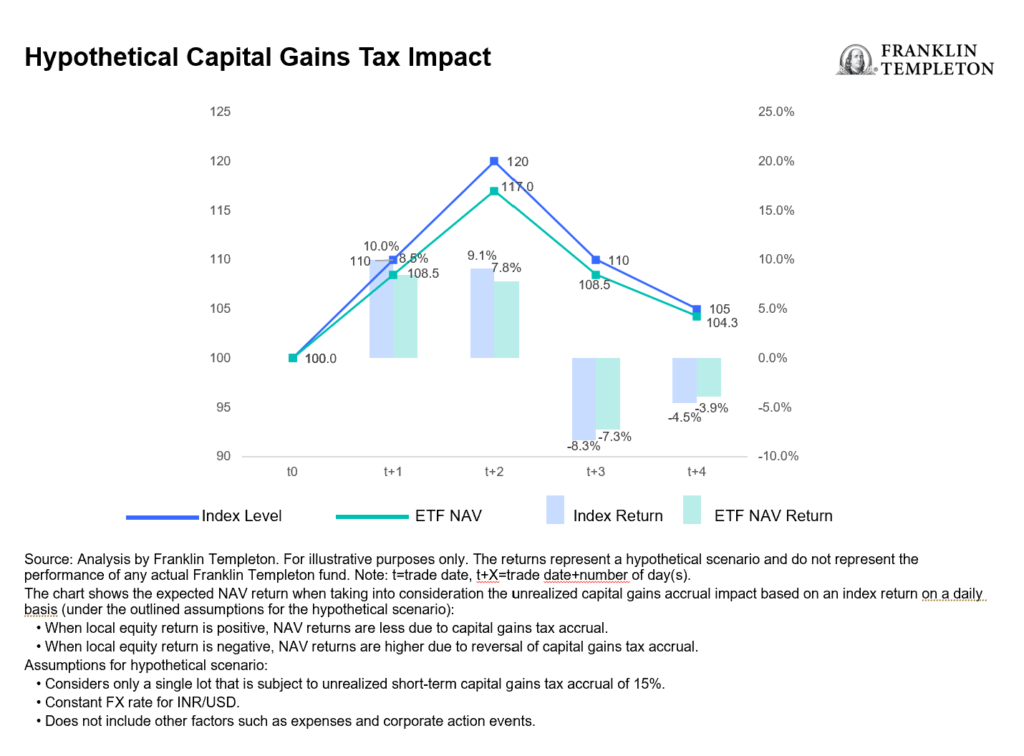

Direct replication funds. • Investors should be aware that in addition to the All-In Fee, other factors may negatively impact the performance of their investment relative to the underlying index. • Examples include: Brokerage and other transaction costs, Financial Transaction Taxes or Stamp Duties as well as potential differences in taxation of either capital gains or dividend assumed in the relevant underlying index, and actual taxation of either capital gains or dividends in the fund. • The precise impact of these costs cannot be estimated reliably in advance as it depends on a variety of non-static factors. Investors are encouraged to consult the audited annual- and un-audited semi-annual reports for details.

db X-trackers UCITS ETFs are all ETFs of one of the following platforms: db x-trackers, db x-trackers II or Concept Fund Solutions plc.

© 2015 Deutsche Bank AG.

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan