Nyheter

Reductions in Supply and Debt Levels Provide Stability in 1Q

Publicerad

8 år sedanden

Reductions in Supply and Debt Levels Provide Stability in 1Q. The first quarter of 2016 was marked by evidence across the commodities spectrum that supply really is reacting both to low prices and low investment, and that a degree of stability may be creeping into markets. This was reflected in the solid improvement in the performance of the Global Hard Assets Fund (the “Fund”) during the quarter. In a dramatic reversal from the fourth quarter of 2015, Class A shares provided a total return for the first quarter of 11.18% (excluding sales charge). The Fund outperformed its commodity equities-based benchmark index, the Standard & Poor’s® (S&P) North American Natural Resources Sector Index (SPGINRTR), which returned 6.26% over the same period.

The Fund’s positions in the Gold, Diversified Metals & Mining, and Energy sectors were, in particular, significant contributors to positive performance. The two strongest contributing sectors were Gold (approximately 15.7% of Fund assets on average during the first quarter) and Diversified Metals & Mining (approximately 6.0% of Fund assets on average during the first quarter). Within the Energy sector, positive performance stemmed mainly from the Oil & Gas Exploration & Production (E&P) sub-industry (approximately 37.4% of Fund net assets on average during the first quarter). Within the Energy sector, the Oil & Gas Refining & Marketing sub-industry (approximately 4.0% of Fund assets on average during the first quarter) contributed negative performance, as did the Fertilizers & Agricultural Chemicals sub-industry (approximately 5.4% of Fund assets on average during the first quarter). During the quarter, the Fund continued to hold no position in Integrated Oil & Gas.

For comparative purposes, we continue to include total return figures for two additional commodity equity indices: the MSCI ACWI Commodity Producers Index (M2WDCOMP) and the Standard & Poor’s® (S&P) Global Natural Resources Index (SPGNRUN).

Fund Contribution

The top five contributing companies for the quarter came from the Diversified Metals & Mining and Gold sectors. Four of these were gold mining companies. During the quarter, as the other major metal miners finally embarked on their debt reduction programs, Glencore (4.2% of Fund net assets at period end*) benefited from the decisions it made back in 2015 to reduce its debt.

The fact that gold miners performed so well in the first quarter of the year provides, to us, strong confirmation that they came in to 2016 considerably more healthy than they have been for quite a while and deserved of a valuation re-rating.

(click to enlarge)

Barrick Gold (2.8% of Fund net assets at period end*) benefited from the restructuring it has been undertaking and its leverage to gold prices. Agnico Eagle Mines Ltd. (4.4% of Fund net assets at period end*) benefited from strong operational performance, its continued focus on cost reduction, and its engineering-related restructuring. Randgold Resources Ltd. (3.2% of Fund net assets at period end*) also benefited from strong operational performance and, not least, from the continuing strength of its balance sheet and the options with which this provided it. Goldcorp (3.3% of Fund net assets at period end*), which is now pursuing “organic” growth from opportunities available internally, rather than through acquisition, felt the benefits from the early stages of the restructuring plan put in place by its new CEO.

The five biggest individual performance detractors came from the Energy, Semiconductor Equipment (a.k.a. Solar) and the Fertilizers & Agricultural Chemicals sectors. Oil & Gas Exploration & Production company, SM Energy Co. (0.9% of Fund net assets at period end*) suffered, particularly in January, from concerns over its level of leverage. In addition to concerns about its leverage and liquidity early in the quarter, SemGroup Corp (0.9% of Fund net assets at period end*), an Oil & Gas Storage & Transportation company involved in midstream services, also faced questions about the status of some of its contracts and what might happen if any of its clients actually went bankrupt. Valero Energy Corp (3.5% of Fund net assets at period end*), an Oil & Gas Refining & Marketing company, suffered from the rebound in crude oil prices.

Semiconductor Equipment (Solar) company SunEdison (sold during the period*) faced considerable headwinds as the market’s interest in yieldcos, and their ability to access capital, continued to diminish. CF Industries Holdings (2.6% of Fund net assets at period end*) was hit by concerns around both Chinese production (which continued unabated) and the value of the Renminbi, in addition to concerns around nitrogen prices.

Market Review and Outlook

The quarter started with continuing concerns about growth in China, but also with concerns about U.S. growth. In January and through early-February, the market was more focused on financial than on economic concerns: about the Renminbi, further currency devaluations, and capital outflows from China. Although these appeared to have abated by the end of the quarter (amongst other things, the U.S. dollar had rolled over, relieving pressure not only on China’s, but also on other currencies), economic concerns still remained, albeit drawing less of a focus. Not least, data started to come through during the quarter indicating not only that Chinese copper purchases for 2015 were at a record level, but so, too, were imports of crude oil.

Both more negative interest rates and less confidence in the abilities of central banks led to gold becoming increasingly attractive during the quarter, particularly as a store of value, not least because it became cheaper to hold on a relative basis. As the price of the metal rose, gold miners, too, benefited. With many of them now having “put their houses in order”, they have been able to leverage a higher gold price and are now in a better spot than they have been at any time in the last four to five years.

In the metals and mining sector, Glencore performed especially well during the quarter. Much of this can be put down to the company’s vigorous and effective actions in addressing its level of debt. Whereas Glencore started really to address its leverage seriously during the third quarter of 2015, only at the end of the 2015, and the beginning of the 2016, did the other senior metals companies start to do the same. In the first quarter, the company continued to execute its plan to de-leverage its balance sheet, a course which it is set to pursue throughout the year, and about which we should expect further announcements in the second quarter. Glencore also benefited from a slight up-tick in metals prices during the first quarter.

During the quarter, there appeared to be no abatement in the geopolitical risks the world faced and still faces, risks that require continual monitoring. The situation in the Middle East continued to fester, despite Russia’s assertion that its job in Syria is now done. The bombings in Brussels and Lahore served only to demonstrate both the reach and ruthlessness of their respective terrorist perpetrators. Within this context, the uncertainty around elections in Germany, France and the U.S. only increased. As it did around the whole issue, and discussion, of Britain’s possible exit from the EU and the subsequent viability of the union were it actually to do so.

In the energy sector, there is clear evidence that crude oil supply is reacting to both current low prices and low investment. Certainly in the U.S., and in countries like Mexico, Brazil, Colombia, the UK (the North Sea) and China, there have been cuts in production. Demand continues to be stable and demand growth “on trend.” As we stated last quarter, although we anticipate a somewhat lackluster outlook for crude for the rest of this half, we are, however, a little more optimistic for the second half of the year.

We have been asked on occasion recently just how the current uptick in crude prices either compares or contrasts with the situation this time last year. We believe that there are a number of fundamental differences. In particular, at the start of 2015, supply was still increasing. The market was coming off a year where demand had disappointed. And while there may have been decent demand/consumption numbers, nobody really knew how solid (or real) they were. The rig count was falling, but was still at near record highs. The U.S. oil rig count may have dropped from 1,600 to 1,200 rigs in a matter of months, but it was still over 1,000 — a massive number! Recently we were at 354.

It is, therefore, not surprising that intense attention has been paid to the current status of production from U.S. oil shale. While the U.S. has accounted for the largest share of supply growth over the last six years, according to the EIA, it is likely to deliver shrinking supply over the next few years. This should come as a shock to no one as capital spending has been slashed and the number of rigs drilling for oil in the U.S. has plummeted, putting drilling activity back to a level roughly similar to the pre-shale oil era.

The intense scrutiny directed at U.S. production is understandable. However, we believe a much deeper structural story that could negatively impact global oil supply for the longer term is being somewhat overlooked. In our view, the underlying business model of the global integrated oil companies is under stress. While independent exploration and production companies reveal eye-popping capital spending cuts of nearly 50%, the integrated oil sector is also slashing spending by an unprecedented amount – nearing hundreds of billions of dollars over the 2014-2016 time period.

While capex and budgets were being cut in the first quarter of 2015, in this quarter they have been absolutely eviscerated. For example, at the beginning of 2015, capex for the integrateds was basically flat year over year. By the end of the year it was down roughly 23%-25%. And their forecast for this year is down approximately another 25%.

This is, indeed, in response to less cash available to invest due to current low oil prices, but it is also driven by poor operating results that have led the boards and executive management teams of these companies to question the likelihood of generating acceptable returns. Exploration success rates and the resultant replacement of reserves have been extremely weak in recent years. Thus, many integrated companies have begun to cancel or postpone projects past 2020.

With crude output in the U.S., Canada, and Iraq likely to be flat or declining over the next several years, where will new supply come from to meet a forecasted annual increase in demand of over one million barrels per day? In our opinion, the results of the integrated companies are an indication that most of the easy and cheap oil in the world has already been tapped and crude prices will need to rise to re-incentivize shale drilling − perhaps on a global basis.

As to what the Organization of the Petroleum Exporting Countries (OPEC) may be planning to do, it’s our opinion that there is no coordinated action between OPEC and Russia. Iran is a law unto itself. However the overhang of Iranian production is dissipating because it has already raised production to about 3.2 million barrels per day with an eventual goal of getting to four million barrels per day. Although it is probably several years out, we would expect its output gradually to approach that goal over those several years.

Equity issuance amongst E&P companies (to maintain the flexibility to drill again at some point) continued in the first quarter, raising more than $10 billion.

Toward the end of March we visited a number of prospective clients (and clients) around Europe. As an indication of how sentiment appears to have changed just this quarter, amongst the most common questions asked of us by the first group was: “Did I miss it?” The question was not had the Fund missed the rebound, but had they, the prospective clients! However, of all of them, only one prefaced the question by describing it as ridiculous. That said, it does remain important to note the difference between where we are now and where we were at the beginning of 2015. The fundamentals are quite different. Now, save for the two big wildcards of what’s going to happen with global growth and what’s going to happen with Iran, all the pieces are in place. Which leads to the question: Is it too late, or is it just the beginning?

One of the main pillars of our investment philosophy continues to be to look for long-term growth and the structural enhancement in intrinsic value in the companies in which we invest. Even in today’s extremely challenging market conditions this continues to be one of our guiding tenets. Since we remain convinced that positioning our portfolio for the future, and not just reacting to current circumstance, is of paramount importance, our focus across the sectors in which we invest remains on companies that can navigate commodity price.

By: Shawn Reynolds, Portfolio Manager

All indices listed are unmanaged indices and include the reinvestment of dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indi¬ces are not securities in which investments can be made. 1The S&P North American Natural Resources Sector Index (SPGINRTR) includes mining, energy, paper and forest products, and plantation-owning companies. 2The MSCI ACWI Commodity Producers Index (M2WDCOMP) is a free float-adjusted market capitalization index designed to reflect the performance of listed commodity producers across three industry (or sub-industry) categories as defined by the Global Industry Classification Standard: energy, metals, and agriculture. 3The S&P Global Natural Resources Index (SPGNRUN) includes 90 of the largest publicly traded companies in natural resources and commodities businesses that meet specific invest-ability requirements, offering investors diversified and investable equity exposure across three primary commodity-related sectors: agribusi¬ness, energy, and metals and mining. 4The S&P Goldman Sachs Commodity Index (SPGSCITR) is a composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures.

Please note that the information herein represents the opinion of the portfolio manager based on the prevailing market conditions and their judgment as of the date of this document. These opinions may change at any time and from time to time. This document is not in¬tended to be a forecast of future events, a guarantee of future results or investment advice. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid. There is no guarantee that any forecasts or opinions in this material will be realized. Historical performance is not indicative of future results; cur¬rent data may differ from data quoted. Current market conditions may not continue. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck. ©2016 VanEck.

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks associated with concentrating its investments in hard assets and the hard assets sector, including pre¬cious metals, natural resources and real estate, and can be significantly affected by events relating to these industries, including international political and economic developments, inflation, and other factors. The Fund’s portfolio securities may experience substantial price fluctuations as a result of these factors, and may move independently of the trends of industrialized companies. The Fund’s investments in foreign securi¬ties involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, or political, economic or social instability. The Fund is subject to risks associated with investments in debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs. The Fund is also subject to inflation risk, market risk, non-diversification risk, leverage risk, credit risk and counterparty risk. Please see the prospectus and summary prospectus for information on these and other risk considerations.

Please call 800.826.2333 or visit vaneck.com for performance information current to the most recent month end and for a free prospectus and summary prospectus. An investor should consider the Fund’s investment objective, risks, and charges and expenses carefully before investing. The prospectus and summary prospectus contain this and other information. Please read them carefully before investing.

Du kanske gillar

Nyheter

Nya obligationsfonder från Amundi ger tillgång till eurostatsobligationer från europeiska länder

Publicerad

7 timmar sedanden

16 maj, 2024

Sedan i torsdags har tre nya börshandlade fonder utgivna av Amundi Asset Management kunnat handlas via Xetra och Börse Frankfurt. Dessa tre nya obligationsfonder från Amundi ger tillgång till eurostatsobligationer från europeiska länder.

Det nya Amundi Fixed Maturity-produktsortimentet investerar i en brett diversifierad portfölj av eurodenominerade statsobligationer som likvideras vid förfallodagen. Ränte- och amorteringsbetalningar från förfallande obligationer återinvesteras i statsobligationer utgivna av Frankrike och Tyskland med en återstående löptid på en månad till sex månader när som helst. Vid förfallodagen får investerarna det nominella värdet av obligationerna på en pro rata-basis och drar fördel av löpande räntebetalningar under denna tid.

Följande tre löptids-ETFer är tillgängliga:

Amundi Fixed Maturity 2028 Euro Government Bond Broad UCITS ETF (AK8E) investerar i statsobligationer emitterade av euroområdets medlemsländer med förfall 2028.

Amundi Fixed Maturity 2028 Euro Government Bond Yield+ UCITS ETF (AK8F) investerar i spanska, italienska och portugisiska statsobligationer med fast ränta som förfaller 2028.

Amundi Fixed Maturity 2027 German Bund Government Bond UCITS ETF (AK8G) investerar i tyska räntestatsobligationer som förfaller 2027.

| Namn | ISIN | Avgift | Utdelnings- policy | Referens- index |

| Amundi Fixed Maturity 2028 Euro Government Bond Broad UCITS ETF | LU2780871401 | 0,09 % | Utdelande | FTSE Euro Broad Government 2028 Maturity Index |

| Amundi Fixed Maturity 2028 Euro Government Bond Yield+ UCITS ETF | LU2780871666 | 0,09 % | Utdelande | FTSE Euro Yield+ Government 2028 Maturity Index |

| Amundi Fixed Maturity 2027 German Bund Government Bond UCITS ETF | LU2780871823 | 0,09 % | Utdelande | FTSE German Government 2027 Maturity Index |

Produktutbudet i Deutsche Börses XTF-segment omfattar för närvarande totalt 2 161 ETFer. Med detta urval och en genomsnittlig månatlig handelsvolym på cirka 14 miljarder euro är Xetra den ledande handelsplatsen för ETFer i Europa.

Nyheter

Valour Chainlink (LINK) SEK ger exponering mot kryptovalutan LINK

Publicerad

8 timmar sedanden

16 maj, 2024

Valour Chainlink (LINK) SEK är en börshandlad produkt som spårar priset på LINK, den inhemska kryptovalutan i Chainlinks ekosystem.

Chainlink är ett decentraliserat orakelnätverk som underlättar smarta kontrakt på blockchain-plattformar för att säkert ansluta till verkliga data, vilket möjliggör genomförandet av förtroendefria och manipuleringssäkra avtal. Det fungerar som en brygga mellan blockkedjebaserade smarta kontrakt och externa datakällor, vilket ger en pålitlig och decentraliserad lösning för att föra information utanför kedjan till blockkedjan.

Produktinformation

| Emittent | Valour Inc. |

| Namn | Valour Chainlink (LINK) SEK |

| ISIN | CH1161139592 |

| Valoren | 116113959 |

| Basvaluta | SEK |

| Underliggande tillgång | CHAINLINK (LINK/USD) |

| Förfallodag | Open-Ended |

| Förvaltningskostnad | 1,9% |

Handla Valour Chainlink (LINK)

Valour Chainlink (LINK) är en europeisk börshandlad produkt som handlas på bland annat Nordic Growth Market.

Det betyder att det går att handla andelar i denna ETP genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Kortnamn | Valuta |

| Nordic Growth Market | VALOUR CHAINLINK (LINK) SEK | SEK |

Nyheter

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

Publicerad

1 dag sedanden

15 maj, 2024

• European Economy Booms while Regulators Consider Adopting Crypto

• Bitcoin’s Growing Fundamentals and Institutionalization

• Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

European Economy Booms while Regulators Consider Adopting Crypto

Europe’s economy has exceeded expectations, with Germany’s gross domestic product (GDP) for Q1 2024 increasing by 0.2%, compared to the previous quarter’s reading of -0.5%. Additionally, France, Italy, and Spain are also seeing progress, picking up the bloc’s GDP from -0.1% to 0.3%. This is a good sign that Europe is on the right track away from a recession. Matching the positive outlook, regulators appear receptive to including new alternative assets within the EU’s most established regulatory framework.

Namely, the European Securities and Markets Authority (ESMA) is considering cryptoassets, among other asset classes like commodities and precious metals, in its Undertakings for Collective Investment in Transferable Securities (UCITS). Similar to mutual funds in the U.S., UCITS funds can be registered and sold in any country in the EU using unified regulatory and investor protection requirements. These funds are considered safe, well-regulated investments, hence their €12T market valuation and popularity among pension funds and risk-averse investors.

On May 7, ESMA invited investors and trade associations, among others, for a consultation to assess possible benefits and risks of UCITS gaining exposure to the selected 19 asset classes, having until August 7 to gather input. This is important since UCITS accounts for 75% of all collective retail investments in the EU. Thus, if the conclusions of this consultation are in favor of adopting crypto, it would attract an influx of investors and bring more regulated accessibility to this asset class. Moreover, although still under consultation, ESMA’s deliberation adds more credibility to crypto, considering the regulator’s renowned strict regulatory standards.

Further, the EU’s inflation is inching towards the 2% target, overshooting by only 0.4% in the past month, a level the U.S. is yet to achieve, with March’s inflation hitting 3.5%. Later today, a strong gauge for inflation is coming out, the Producer Price Index (PPI), measuring the change in the price of finished goods and services sold by producers. With the last consumer price index (CPI) disappointing, all eyes are on the CPI print coming out this Wednesday, along with data on retail sales. Although optimism seems to have checked out, a cooled inflation rate would recover investors’ appetite for risk-on assets like crypto, instigating more flows into Bitcoin spot ETFs, which have been especially quiet over the past week, as shown in Figure 1.

Figure 1: US Spot Bitcoin ETFs Flows

Source: Glassnode

Nevertheless, Bitcoin’s narrative has been growing beyond its primary use case as a store of value, with companies and governments alike leveraging Bitcoin mining to reduce their negative impact on the environment, ironically something Bitcoin is often scrutinized for.

Bitcoin’s Growing Fundamentals and Institutionalization

On May 7, Genesis Digital Assets and Argentina’s state-owned YPF Luz, the country’s largest producer of oil and gas with a ∼40% share in 2021, announced their opening of a Bitcoin mining facility. The data center takes ‘stranded gas,’ a byproduct of oil and gas production that would otherwise be flared and contribute to greenhouse gas emissions, to power the mining operation with the potential to reduce carbon dioxide equivalent emissions by 25-63%. Notably, 50 major oil and gas companies, representing over 40% of global petroleum production, signed the Oil and Gas Decarbonization Charter (OGDC), thereby committing to end gas flaring by 2030. The Argentinian project serves as a prime example of how companies can achieve the goals outlined in the OGDC, an approach likely to be replicated by others potentially using Bitcoin.

Aside from the obvious environmental benefits, projects like these actually strengthen Bitcoin’s network! More miners joining the fray means greater computing power, reflected by the growing hash rate in Figure 2. This results in a more secure network, as 51% attacks become more costly to execute successfully. The development comes at a crucial point in time, calming fears over miners exiting the network to cover costs, a dynamic often witnessed post-halving and one we explored in our Bitcoin Halving Report.

Figure 2 – Bitcoin Growing Hash Rate

Source: 21co on Dune

On a more familiar note, institutions continue to gobble up Bitcoin as an investment opportunity. The recent 13F filings mentioned last week revealed a growing appetite for Bitcoin as investment managers continue to disclose their U.S. equity holdings to the SEC. Quantitative trading firm Susquehanna holds over $1B in Bitcoin ETFs, with Boston-based hedge fund Bracebridge disclosing their $380M position too. Furthermore, in Japan, a weakened yen and government debt reaching 250% of GDP confirms sustained economic pressure, which has led early-stage investment firm Metaplanet to adopt Bitcoin as a strategic reserve. They have acquired over $7M since April, another testament to Bitcoin’s value proposition as a safe haven. The continuous adoption of Bitcoin is no surprise, given the accessibility of Bitcoin ETFs to traditional institutions through a regulated and familiar investment vehicle.

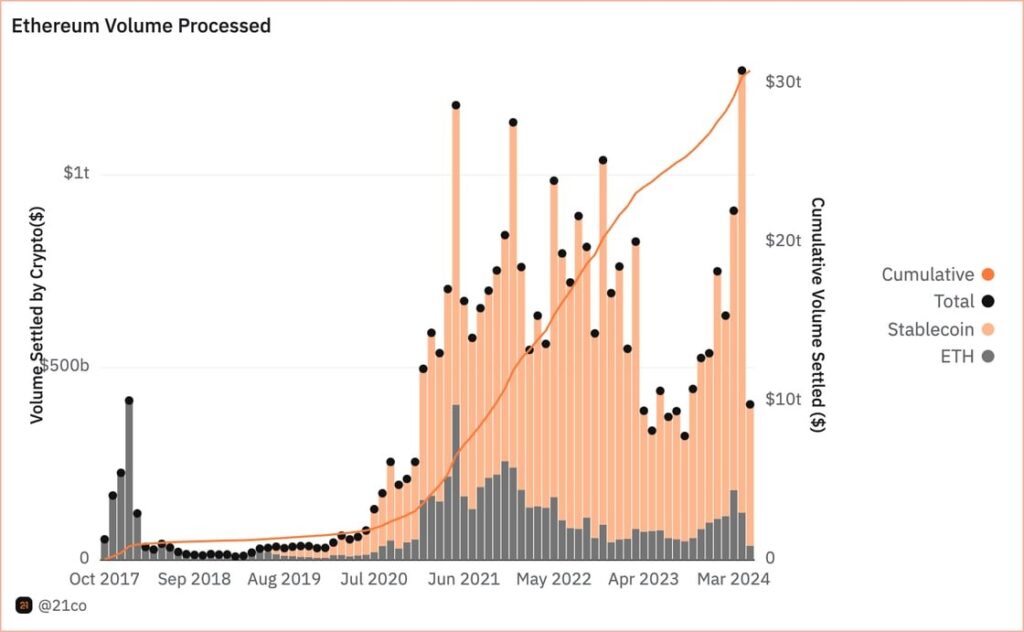

The positive Bitcoin sentiment is amplified by continuous innovation on the network itself. Bitcoin’s prime scaling solution, the Lightning Network, has taken a significant leap forward. By leveraging the Taproot Asset Upgrade, the Lightning Network successfully tested a protocol for issuing stablecoins directly on Bitcoin. This underscores the trend of Bitcoin’s growing use cases following the launch of Runes, which unlocked the ability to launch fungible tokens on Bitcoin. The recent surge in on-chain activity is reminiscent of the ERC-20 explosion in Ethereum’s early days, and stablecoins would truly unlock Bitcoin’s DeFi potential. They facilitate a wide range of transactions, shown below by Ethereum stablecoins amassing $3.8T in 2024 processed volume so far.

Figure 3 – Ethereum Stablecoin Volume

Source: 21co on Dune

While still in the early stages, this development would also significantly boost miner revenue, offering them a much-needed additional income stream through transaction fees, following the halving of block rewards last month. The potential of stablecoins on Bitcoin will be monitored going forward, as they have clear implications for the network’s potential on-chain footprint.

Ethereum’s Next Leap Forward: A Glimpse at the Upcoming Upgrade

More information is finally starting to come out regarding Ethereum’s next major upgrade, slated for late this year or early next year. Known as Pectra, the upgrade promises to introduce a range of enhancements aimed at bolstering the network’s stability and refining user experience. For example, the upgrade will raise the maximum stake per validator from 32 to 2,048 ETH, streamlining the management process for large validators who spread their stake across multiple wallets. Moreover, Pectra will tackle the problem of empty accounts, those with zero assets or funds, by removing them from the network. This action reduces the network’s state size, which effectively leads to lighter transaction processing.

Although the upgrade will incorporate various Ethereum Improvement Proposals (EIPs), one in particular stands out. Referred to as EIP 7702, Vitalik Buterin’s new proposal aims to expand upon the advancements made in Account Abstraction (AA) on Ethereum by refining certain concepts introduced in an earlier proposal, EIP 3074. As a quick recap, AA transforms users’ wallets, externally owned accounts (EOAs), into more sophisticated accounts resembling smart contracts, enhancing security, flexibility, and simplified user management. That said, EIP 7702 addresses some of EIP 3074 criticisms by steering clear of dependencies on EOA-specific functionalities. It aims to establish a versatile system capable of meeting the evolving needs of the Ethereum ecosystem while helping to reduce technical debt for the network

However, EIP 7702 proposes several other enhancements, including batched transactions, which could enhance transaction efficiency and even reduce fees by consolidating multiple user actions. Another exciting feature is the introduction of s sponsored transactions, which allow third-party applications to cover transaction fees for consumers, an ideal solution for onboarding new users. Finally, the upgrade could make users’ accounts resistant to threats from quantum computing. That said, with the proposal’s introduction of a new transaction type enabling EOAs to temporarily transition into smart accounts, concerns arise regarding the heightened risk of malicious actors’ ability to swiftly drain user wallets. Nevertheless, Vitalik’s proposal is intriguing as it charts a more pragmatic course toward realizing the AA vision. This is pivotal because it echoes our thesis at 21Shares that crypto won’t onboard millions of more users without providing them with an intuitive interface resembling the user-friendly experience they are familiar with across Web2.

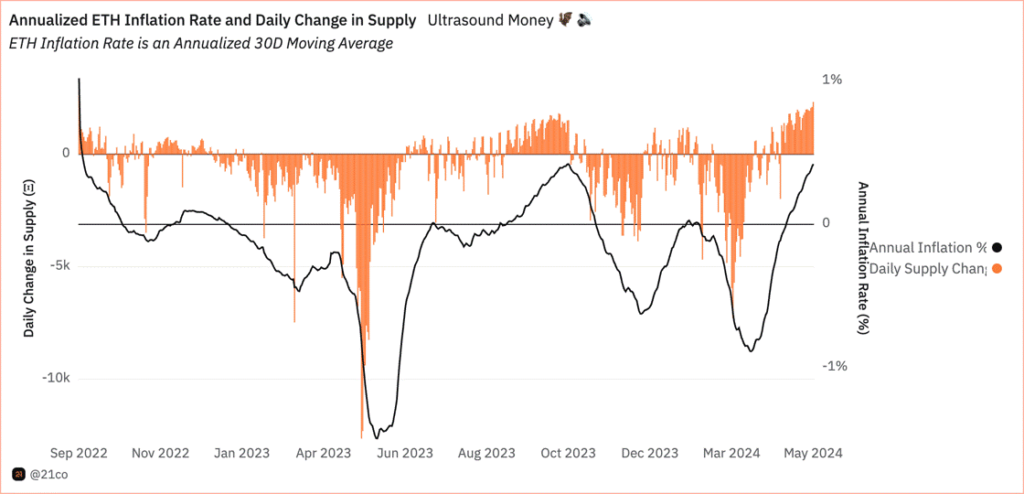

Now, while Ethereum’s long-term prospects remain promising, its status as a deflationary network has come under threat in recent weeks, as seen below in Figure 3. This decline is primarily attributed to decreasing on-chain activity, which peaked at the end of March. Furthermore, the DenCun upgrade, implemented in March, significantly reduced the costs L2s incurred for storing their data on Ethereum by 90%.

Figure 4 – Ethereum’s Inflation

Source: 21co on Dune

It is worth noting that while it is currently more cost-effective for L2s to operate on Ethereum, these reduced costs will eventually onboard a larger user base. This will make it more feasible for applications, especially those requiring a high volume of interactions, to operate within the Ethereum ecosystem, which was previously economically unviable. A pivotal piece of evidence supporting this perspective is Arbitrum’s recent milestone, onboarding approximately 600K daily active users, as depicted in Figure 4. This likely influenced Securitize’s decision to propose deploying Blackrock’s BUIDL on Arbitrum, considering its position as the pioneering L2 platform with such a vibrant user base, alongside being the first L2 to process over $150B in swap volume on Uniswap, putting Arbitrum as the leading Ethereum scaling solution. Nevertheless, readers shouldn’t be wary, as we expect a broader spectrum of applications to arrive at the Ethereum network, helping to fill in the gap for Ethereum’s lost revenue while expanding the universe for what is possible within its ecosystem.

Figure 4 – Daily Active Users of Ethereum’s Leading Solutions

Source: GrowThePie

This Week’s Calendar

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nya obligationsfonder från Amundi ger tillgång till eurostatsobligationer från europeiska länder

Valour Chainlink (LINK) SEK ger exponering mot kryptovalutan LINK

Bitcoin Warms up to Climate Goals and Ethereum’s Next Milestone: What Happened in Crypto This Week?

CRPA ETF investerar i företagsobligationer och återinvesterar utdelningen

Timely and concise insights on Bitcoin & Cryptoasset Markets

Vilken är den bästa fond som följer Nasdaq-100?

De mest populära börshandlade fonderna april 2024

Några av de bästa guldfonderna

Sveriges enda riktiga råvarufond har öppnat

Endast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVilken är den bästa fond som följer Nasdaq-100?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDe mest populära börshandlade fonderna april 2024

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNågra av de bästa guldfonderna

-

Nyheter4 dagar sedan

Nyheter4 dagar sedanSveriges enda riktiga råvarufond har öppnat

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanEndast en tredjedel av brittiska privatinvesterare har hört talas om ansvarsfulla investeringar eller ESG

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanU.S. Global Investors tar över HANetf Travel

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBTC1 ETP spårar priset på kryptovalutan Bitcoin

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNy ETF från UBS ger tillgång till företag på utvecklade marknader med valutasäkring i euro